Sue Robb of 4Children talks to Julie Laughton and Alison Britton from the Department for Education about the role of childminders in delivering the 30 hours free entitlement.

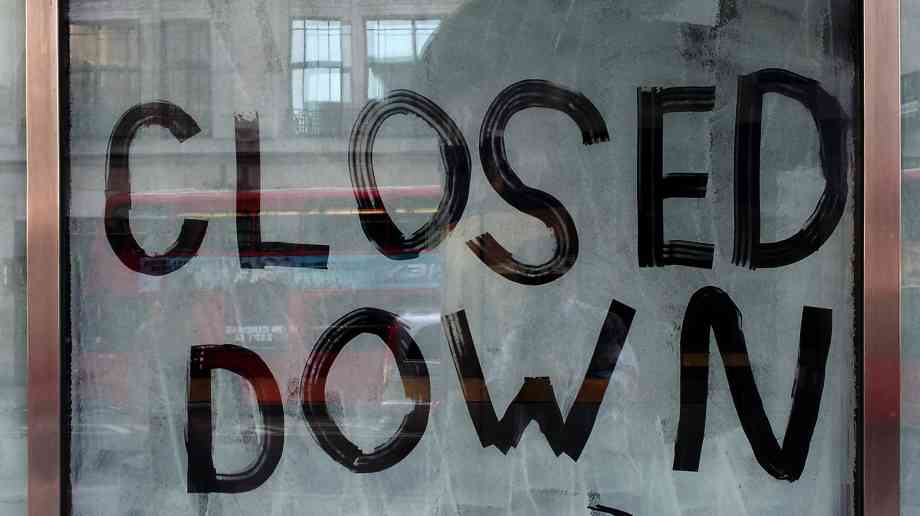

High Street exits remain at historic high

New research has found that a record net 2,481 stores disappeared from Great Britain’s top 500 high streets last year, as openings slump to lowest levels on record.

The PwC research, compiled by the Local Data Company, shows that the number of store openings by multiple retailers on Britain’s top 500 high streets has dropped by 17.4 per cent year on year with the current rate of openings at nine stores per day. This represents a 44 per cent decrease from the 16 stores per day opening in 2013.

The shortfall between openings and closures reached its highest level since the beginning of the decade, as withdrawals from the high street were further dented by a historic low number of store openings.

The roll out of gyms leads the growth categories, as high streets begin to pivot away from retail; while other growth categories were dominated by entertainment and indulgence with bookshops, ice cream parlours and cake shops all in the top five.

Lisa Hooker, consumer markets leader at PwC, said: “The results are clear - 2018 was a turbulent year for retailers with a number of high profile store closures. We saw an acceleration in footfall decline on the high street with businesses continuing to see the impact of online shopping, increasing costs and subdued consumer spending.

“It’s interesting that the marked reduction in openings has accelerated the net closure trend. In categories as diverse as fashion and financial services, new entrants are able to gain share by launching online - enabled by technology and consumer adoption of mobile and e-commerce - rather than be saddled with the costs and risks of opening on the high street.

“The high street of the future will be a more diverse space, not solely dependent on stores. The analysis reflects this with the net growth of gyms and sports clubs, ice cream parlours and cake shops, in addition to initiatives to bring more shared office spaces and homes into what were traditionally shopping areas. However, it’s clear that the rate of openings is not currently enough to offset the closure of traditional retailers and services, so some tough decisions will need to be taken in the next few years.”

Looking at the first quarter of 2019, LDC data finds that closure rates remain high as 1,358 outlets alongside 849 openings.

Company Focus

Just Lanyards is a subsidiary name of Gifts 2 Impress Limited, who have been trading for over 25 years, we therefore pride ourselves in having endless experience covering all aspects of the promotional merchandise industry.

Event Diary

UKREiiF has quickly become a must-attend in the industry calendar for Government departments and local authorities.

The multi-award-winning UK Construction Week (UKCW), is the UK’s biggest trade event for the built environment that connects the whole supply chain to be the catalyst for growth and positive change in the industry.

Supplier Profiles

Geo Energy

At GeoEnergy Design, we're on a mission to disrupt the traditional way heating and cooling ha

Latest Features

Professor Harith Alani, director of the Knowledge Management Institute at the Open University explains how AI can be used for good and bad.

Alex Lawrence, head of health & social care, techUK sets out techUK’s Five Point Plan for CareTech.