Sue Robb of 4Children talks to Julie Laughton and Alison Britton from the Department for Education about the role of childminders in delivering the 30 hours free entitlement.

Smart Cities, Big Data and the Built Environment

The smart city and big data agendas offer exciting benefits and opportunities for local authorities, people living in cities, and the business sector. The built environment sector has a key role to play in helping shape this revolution in data provision at city level. But how should the sector and other actors respond to key challenges, particularly as the UK government promotes further city devolution? Tim Dixon explains

We live in an increasingly urbanised world. Currently more than 50 per cent of the world’s population live in cities, and this is set to grow to nearly 70 per cent by 2050. Recently, we have seen a greater focus on information and communications technology (ICT) to argue the case for ‘smart cities’. This places a strong emphasis on an ICT-led and a ‘data-driven’ future, which also positions the development of new products, processes, organisational methods and markets at the heart of the continued ambition for sustainable urban economic growth.

City data can be divided into three main categories of data: ‘flows’ of resources, products, people and information across cities, measured by sensors; ‘states’ of urban spaces and environments, which measures, for example, density of people and environmental factors through sensors, satellite imagery or continuous observation; and ‘activities’ of people, machines and devices, and the measurement of transaction, consumption and communication patterns.

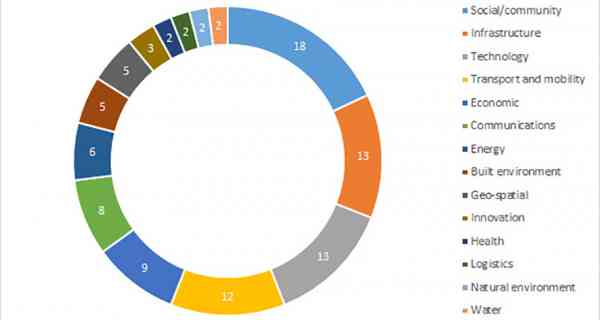

This data can also cover a range of specific areas (Figure 1). In a built environment context city data relates to land and buildings, energy and environment, transport and mobility, and health and well-being. This data may be produced and held by a number of stakeholders, including built environment professionals from property, construction, architecture and planning. This offers big opportunities for improved energy performance analysis of buildings, applications in financial markets, property transactions, predictive asset management and Building Information Modelling (BIM).

City data can also be categorised as ‘open’ (accessible, public data) or ‘big’ (large volume and rapidly varying and generated) data, although in some instances there may also be a degree of overlap between the two categories.

In short, the interconnected agendas of smart cities, and big data and open data could provide exciting opportunities for many service providers, including built environment professionals. But, what in reality will those opportunities be, and what are the challenges? Recent research for the RICS Research Trust by the University of Reading has focused on answering these questions.

The big picture in UK smart cities

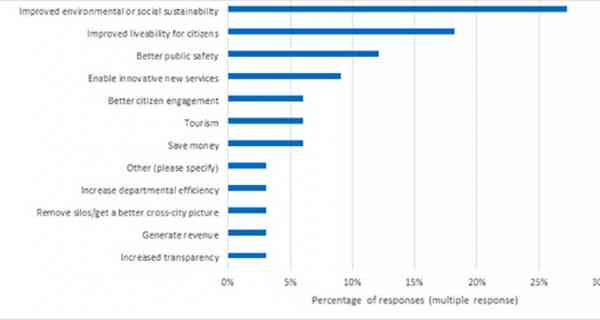

Firstly, the research found that there is a worrying lack of strategy in UK smart cities and the current thinking is on open data rather than big data. Only 47 per cent of the 19 cities in the survey had an established definition for a smart city, with a majority adopting the BSI smart city definition [1]. Moreover, high level planning at city level is not common; only 22 per cent of respondents had a smart city action plan and only 22 per cent had a smart city framework. Similarly, only 33 per cent of respondents stated their city had a data strategy and only 22 per cent stated that the strategy mentioned big data. On the other hand, some 61 per cent of respondents suggested their city had an open data platform, and cities did also recognise the key benefits of undertaking smart city built environment projects (Figure 2).

The research also examined four case studies in detail: Milton Keynes and Bristol (UK); Amsterdam (Netherlands) and Taipei (Taiwan). Although there were some good examples of big data built environment projects, there was also a marked lack of engagement by the built environment sector (property and construction), both in terms of direct data provision to data platforms at city level and in terms of direct engagement with smart city built environment projects at city level.

The challenges of built environment big data

Despite the promise of big data, this research highlights a number of challenges surrounding the development of big data projects in the built environment. Firstly, definition and measurement: defining what we mean by ‘big data’ is difficult. Different meanings and interpretations can be put on the term and distinctions in the terminology were seen as unhelpful. Secondly, business engagement: moving the debate beyond simply government or local government led initiatives is proving difficult. Part of the solution might be a market-based data exchange at city level (Milton Keynes), or the development of different data platforms for cities (Amsterdam).

Additionally, interoperability: the ability of different ICT systems to work with a variety of datasets is also a critical issue to bear in mind. The proliferation of data standards and general fragmentation in the built environment sector (actors working to their own specific objectives without seeing the value of working across their operational ‘silos’) is not helpful. Lastly, top-down approach: the smart city agenda is very much ‘top down’, with much of the impetus provided by software and hardware vendors, whereas in fact what is needed was a ‘bottom up’ demand focused approach, provided through a more BIM-led, asset management focus.

Overcoming the barriers and enabling the built environment sector to engage in smart cities, big and open data requires a more detailed appraisal of two key issues: understanding the use and supply of built environment big data and recognising the changing roles of stakeholders.

Use and supply of built environment big data

There needs to be a primary focus on procurement and digital assets. Firstly, there is a need to understand the requirements of the built environment sector in terms of data. Secondly, the future use of data needs to be tackled by embedding interoperability in the built environment sector, and focusing on how the data will be used in the context of the smart city.

Engagement at the right time and with the right stakeholders is important. The contractors and delivery partners in projects need to discuss options for data gathering, sharing and analysis with their clients at the procurement stage. Citizen engagement is also vital: people must be able to understand data gathering and sharing in the development process, as well as understanding the benefits and drawbacks of data sharing.

Creating trust and brand is important in the built environment sector. This begins with agreement upon common data standards and a common language for data. The real estate and construction sectors can learn from other industries such as tech, retail and the aircraft industry, where trust and brand are paramount. Dealing with liability and regulation will also be increasingly important to consider. For example, what happens when projects fail, or decision-making is based on incorrect data? Data quality, provenance, validation and security are therefore all important issues to consider in the built environment sector.

Recognising the changing roles of stakeholders

Cities need to develop clear smart city strategies and data strategies (covering big data and open data) which provide greater certainty for all stakeholders. There need to be improved incentives for companies to provide open data and big data, through the development of viable commercial business models. Professional bodies within the built environment sector (including RICS and RIBA) need to determine what role they and their members should have in relation to data (both open and big) in the context of smart cities.

Promoting the agenda through champions for change in the professional bodies is vital and collaboration across the built environment professions is a critical issue to address. Data skills and smart city skills (relating to data analytics and data management, for example) are cross-cutting skills which also need to be embedded within professional competencies. Built environment professionals also need to be able to gain a much better understanding of the data needs and requirements of their clients, as well as the potential impacts of big and open data on professional advice in this area.

It will also be important for the professional bodies to be more closely aligned with tech companies, city authorities and other stakeholders in the smart city agenda. This will help provide further impetus to enable all stakeholders to work together to deliver improved services for citizens.

Opportunities for joined-up thinking

With directly elected mayors in large cities such as London, Liverpool and Bristol, and the six large metro regions, mayors will need to consider how improved big and open data provision can help enrich the lives of their populations [2]. In particular, newly elected city mayors need to work hard to promote increased collaboration between local authorities, the built environment sector, and technology companies, to harness the potential power of built environment data. As this research shows, a key priority is for such cities is the need to develop clear smart city and data strategies to demonstrate the benefits for citizens and help improve incentives for companies to share their data.

Tim Dixon is Professor in Sustainable Futures in the Built Environment, at the University of Reading’s School of the Built Environment.

The Environment: What's Required? report is available here - http://www.rics.org/Global/RICS-Smart-Cities-Big-Data-REPORT-2017.pdf

[1] ‘Smart city’ refers ‘effective integration of physical, digital and human systems in the built environment to deliver a sustainable, prosperous and inclusive future for its citizens’ (BSI, 2014).

[2] After the General Election the All Party Parliamentary Group on Smart Cities (http://www.smartcitiesappg.com/) will be publishing a short ‘top tips’ guide on smart cities for metro mayors.

Company Focus

Just Lanyards is a subsidiary name of Gifts 2 Impress Limited, who have been trading for over 25 years, we therefore pride ourselves in having endless experience covering all aspects of the promotional merchandise industry.

Event Diary

UKREiiF has quickly become a must-attend in the industry calendar for Government departments and local authorities.

The multi-award-winning UK Construction Week (UKCW), is the UK’s biggest trade event for the built environment that connects the whole supply chain to be the catalyst for growth and positive change in the industry.

Supplier Profiles

Geo Energy

At GeoEnergy Design, we're on a mission to disrupt the traditional way heating and cooling ha

Latest Features

Professor Harith Alani, director of the Knowledge Management Institute at the Open University explains how AI can be used for good and bad.

Alex Lawrence, head of health & social care, techUK sets out techUK’s Five Point Plan for CareTech.